The SEDEMAC Mechatronics IPO began on 04-March-2026. It will close on 06-March-2026. The Total IPO Size is 1,087 Crores. The company set its IPO price at 1287-1352 Rs Per Share.

The SEDEMAC Mechatronics IPO began on 04-March-2026. It will close on 06-March-2026. The Total IPO Size is 1,087 Crores. The company set its IPO price at 1287-1352 Rs Per Share.

There are three basic categories in SEDEMAC Mechatronics IPO Subscription: 1) Qualified Institutional Buyers, 2) Non-Institutional Investors, and 3) Retail.

SEDEMAC Mechatronics is a a Deep Tech Company which Designs, Manufactures and Supplies Advanced Control- Intensive, Critical-to-the-application Electronic Control units (ECUs) to the Leading OEMs and Industrial Players.

The Company is Among Top 4 Largest Indian of ISG ECUs to 2/3Ws with 35% Market Share and India’s Largest Supplier of Genset Controllers with more share than 75% Market Share.

The Products are made entirely in-house and are Super Critical in Nature. Majority of Revenue comes from Critical Products (85%).

Products are Served to Engine Powered 2/3Ws, Electric Vehicles and to Industrial Segments such as Generators.

Products Portfolio:

– Integrated Starter Generator (ISG) ECU

– Electronic Fuel Injection (EFI) ECU

– ISG+EFI ECU

– EV motor controllers (MCUs)

– Genset Control Units

– Rare-Earth Free Motors

– Engine EFI ECUs

– TCI/VRRs/Flashers

– Magnetos

SEDEMAC Mechatronics IPO Promoters

Prof. Shashikanth Suryanarayanan, Amit Arun Dixit, Manish Sharma and Anaykumar Avinash Joshi are the promoters of the company.

SEDEMAC Mechatronics IPO Date, Details & Price Band

The SEDEMAC Mechatronics IPO Price Band, IPO Dates, Market lot and other details are mentioned in the table below.

| IPO Opening Dates | 04-March-2026 |

| IPO Closing Dates | 06-March-2026 |

| Price | 1287-1352 Rs |

| Fresh Issue | NIL |

| Offer for sale | 1,087 Crores |

| Total IPO size | 1,087 Crores |

| Face Value | 10 INR Per Share |

| Issue Type | Book Built Issue |

| Listing On | NSE, BSE |

| QIB Allocation | 50% |

| HNI Allocation | 15% |

| Retail Allocation | 35% |

| Market Cap | 5,970.63 Crores |

SEDEMAC Mechatronics IPO Market Lot

The SEDEMAC Mechatronics IPO minimum market lot is 11 shares with a ₹14,872 Amount per application.

| Lot | No of Shares | Amount | |

| Retail Minimum | 1 | 11 | ₹14,872 |

| Retail Maximum | 13 | 143 | ₹1,93,336 |

| S-HNI Minimum | 14 | 154 | ₹2,08,208 |

| S-HNI Maximum | 67 | 737 | ₹9,96,424 |

| B-HNI Minimum | 68 | 68 | ₹10,11,296 |

Restated Consolidated Financial Information (Amt. in Crore)

| Total Assets | Total Revenue | Profit After Tax | |

| 30-Sep-25 | 676.01 | 775.31 | 71.50 |

| 31-Mar-25 | 491.16 | 662.54 | 47.05 |

| 31-Mar-24 | 402.24 | 535.90 | 5.88 |

| 31-Mar-23 | 331.28 | 429.87 | 8.57 |

SEDEMAC Mechatronics IPO GMP & Grey Market Premium

The SEDEMAC Mechatronics IPO GMP (Grey Market Premium) has started today. Check the Latest SEDEMAC Mechatronics IPO GMP, Kostak Rates, and Subject to Sauda Price here.

SEDEMAC Mechatronics IPO Prospectus

The SEDEMAC Mechatronics IPO Prospectus is Available on the NSE/BSE and SEBI websites, as well as on our Portal. Please click here to download the SEDEMAC Mechatronics IPO Prospectus.

| DRHP | Download |

| RHP | Download |

| Anchor Investor List | Download |

SEDEMAC Mechatronics IPO Allotment Date & Details

| Allotment Date | 09-Mar-2026 |

| Initiation of refunds | 10-Mar-2026 |

| Transfer of shares to Demat accounts | 10-Mar-2026 |

| Listing Date | 11-Mar-2026 |

| Check Allotment Status | Click here |

SEDEMAC Mechatronics IPO Registrar

MUFG Intime India Private Limited

(Formerly Link Intime India Private Limited)

C-101, Embassy 247,

L B S Marg, Vikhroli (West)

Mumbai 400 083

Maharashtra, India

Tel: +91 810 811 4949

Email: [email protected]

Investor Grievance ID: [email protected]

Website: www.in.mpms.mufg.com

Contact Person: Shanti Gopalkrishnan

SEBI Registration Number.: INR000004058

SEDEMAC Mechatronics Contact Details

SEDEMAC Mechatronics Ltd

Survey No. 270/1/A/2,

Pallod Farms Baner Road, Baner,

Baner Gaon, Haveli

Pune, Maharashtra, 411045

+91 20 6715 7200

[email protected]

SEDEMAC Mechatronics IPO Lead Managers

Axis Capital Limited

Axis House, 1st Floor

Pandurang Budhkar Marg

Worli, Mumbai 400 025

Maharashtra, India

Tel: +91 22 4325 2183

Email: [email protected]

Investor Grievance ID: [email protected]

Website: www.axiscapital.co.in

Contact Person: Simran Gadh/ Pratik Pednekar

SEBI Registration Number: INM000012029

ICICI Securities Limited

ICICI Venture House

Appasaheb Marathe Marg

Prabhadevi, Mumbai 400 025

Maharashtra, India

Tel: +91 22 6807 7100

Email: [email protected]

Investor Grievance ID: [email protected]

Website: www.icicisecurities.com

Contact Person: Tanya Tiwari/ Nikita Chirania

SEBI Registration Number: INM000011179

Avendus Capital Private Limited

Platina Building, 9th Floor 901

Plot No C-59 Bandra-Kurla Complex

Bandra (East), Mumbai 400 051

Maharashtra, India

Tel: +91 22 6648 0050

Email: [email protected]

Investor Grievance ID: [email protected]

Website: www.avendus.com

Contact Person: Sarthak Sawa

SEBI Registration Number.: INM000011021

The Omnitech Engineering IPO began on

The Omnitech Engineering IPO began on The PNGS Reva Diamond Jewellery IPO began on

The PNGS Reva Diamond Jewellery IPO began on The Shree Ram Twistex Solutions IPO began on

The Shree Ram Twistex Solutions IPO began on The Clean Max Enviro Energy Solutions IPO began on

The Clean Max Enviro Energy Solutions IPO began on The Gaudium IVF & Women Health IPO began on

The Gaudium IVF & Women Health IPO began on The Aye Finance IPO began on

The Aye Finance IPO began on The Shadowfax Technologies IPO began on

The Shadowfax Technologies IPO began on The Amagi Media Labs IPO began on

The Amagi Media Labs IPO began on The Bharat Coking Coal IPO began on

The Bharat Coking Coal IPO began on The Turtlemint Fintech Solutions IPO began on

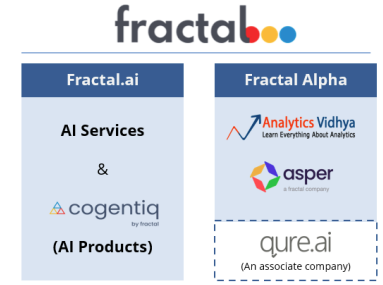

The Turtlemint Fintech Solutions IPO began on There are three basic categories in Fractal Analytics IPO Subscription: 1) Qualified Institutional Buyers, 2) Non-Institutional Investors, and 3) Retail.

There are three basic categories in Fractal Analytics IPO Subscription: 1) Qualified Institutional Buyers, 2) Non-Institutional Investors, and 3) Retail.

The Deepa Jewellers IPO began on

The Deepa Jewellers IPO began on The Gujarat Kidney & Super Speciality IPO began on

The Gujarat Kidney & Super Speciality IPO began on The KSH International IPO began on

The KSH International IPO began on