The TBO Tek has begun on 08-May-2024. It will close on 10-May-2024. The Total IPO Size is 1,550.81 Crore. The company set its IPO price is 875-920 Rs Per Share.

TBO Tek IPO Subscription is divided into three categories 1) Qualified Institutional Buyers 2) Non-Institutional Investors 3) Retail.

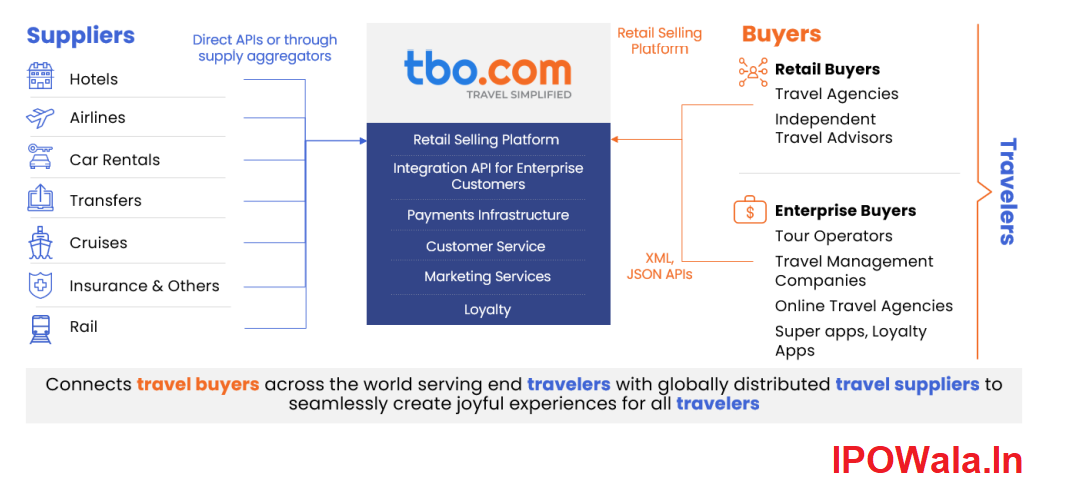

TBO Tek is a top travel distribution platform in the world’s travel and tourism sector in terms of GTV and revenue from operations for Fiscal 2023.

They operate an online B2B travel distribution platform ( tbo.com ) that provides a wide range of offerings and connects Buyers and Suppliers. By using their platform suppliers such as hotels, airlines, car rentals, transfers, cruises, insurance, rail and others can connect with buyers such as travel agencies, independent travel advisors, tour operators, travel management companies, online travel companies, super applications and loyalty applications thereby streamlining the entire process

They providing a wide range of offerings operating in over 100 countries.

TBO Tek IPO

They have two key revenue models for their transaction.

1) B2B Rate Model : They receive inventory from their Suppliers at a special B2B rate. They apply a certain mark-up on this rate and

pass this price on to Buyers.

2) Commission Model : The Suppliers fix the price at which they want to sell to the end traveller. They receive commission on each such transaction from the Supplier, part of which they retain and part of which we share with the Buyer.

TBO Tek Promoters Details

Ankush Nijhawan, Gaurav Bhatnagar, Manish Dhingra, and Arjun Nijhawan are the Promoters of the company.

TBO Tek IPO Date, Details & Price Band

The TBO Tek IPO Price Band, IPO Dates, Market lot and other details mention in be below table.

| IPO Opening Dates | 08-May-2024 |

| IPO Closing Dates | 10-May-2024 |

| Price Band | 875-920 Rs |

| Fresh Issue | 400 Crore |

| OFS | 1,150.81 Crore |

| Total IPO size | 1,550.81 Crore |

| Minimum bid (lot size) | 16 Shares |

| Face Value | 1 INR Per Share |

| Issue Type | Book Built Issue IPO |

| QIB Allocation | 75% |

| HNI Allocation | 15% |

| Retail Allocation | 10% |

| Listing On | NSE, BSE |

TBO Tek IPO Market Lot

The TBO Tek IPO minimum market lot is 16 shares With 14,720 ₹ Amount per application.

| Lot | No of Shares | Amount | |

| Retail Minimum | 1 | 16 | 14,720 ₹ |

| Retail Maximum | 13 | 208 | 1,91,360 ₹ |

Restated Financial Record of the three year (Amt. in Crore)

| Total Assets | Total Revenue | Profit After Tax | |

| 31-Mar-23 | 2,557.93 | 1,085.77 | 148.49 |

| 31-Mar-22 | 1,271.43 | 511.93 | 33.72 |

| 31-Mar-21 | 576.16 | 176.55 | -34.14 |

TBO Tek IPO GMP & Grey Market Premium

TBO Tek IPO GMP Grey market premium has been started today. Check Latest TBO Tek IPO GMP, Kostak Rates and Subject to Sauda Price here.

TBO Tek IPO Prospectus

TBO Tek IPO Prospectus Available on BSE and Sebi Website as well as on our Portal. Please click here to Download TBO Tek IPO Prospectus.

| DRHP | Download |

| RHP | Download |

| Anchor Investors List | Download |

TBO Tek IPO Reviews

Angel Broking – Update Soon

Choice Broking – Update Soon

Prabhudas Lilladher – Update Soon

TBO Tek IPO Form Download

TBO Tek IPO form Available on NSE, BSE Website as well as on our Portal. Please click here to Download TBO Tek IPO forms.

TBO Tek IPO Allotment Date & Details

| Allotment Date | 13-MAY-2024 |

| Initiation of refunds | 14-MAY-2024 |

| Transfer of shares to Demat accounts | 14-MAY-2024 |

| Listing Date | 15-MAY-2024 |

| Check Allotment Status | Click here |

Registrar of TBO Tek

KFin Technologies Limited (formerly

known as KFin Technologies Private Limited)

Selenium, Tower B, Plot No. 31 and 32,

Financial District

Nanakramguda, Serilingampally

Hyderabad – 500 032

Telangana, India

Telephone: +91 40 6716 2222

E-mail: [email protected]

Website: www.kfintech.com

Investor Grievance E-mail:

[email protected]

Contact Person: M. Murali Krishna

SEBI Registration No: INR000000221

TBO Tek Contact Details

TBO Tek Limited

E – 78,

South Extension Part I,

New Delhi – 110 049

Phone: +91 124 499 8999

Email: [email protected]

Website: http://www.tbo.com/

TBO Tek IPO Lead Managers

Axis Capital Limited

Goldman Sachs (India) Securities Private Limited

Jefferies India Private Limited

JM Financial Limited